Bollinger bands and keltner channels

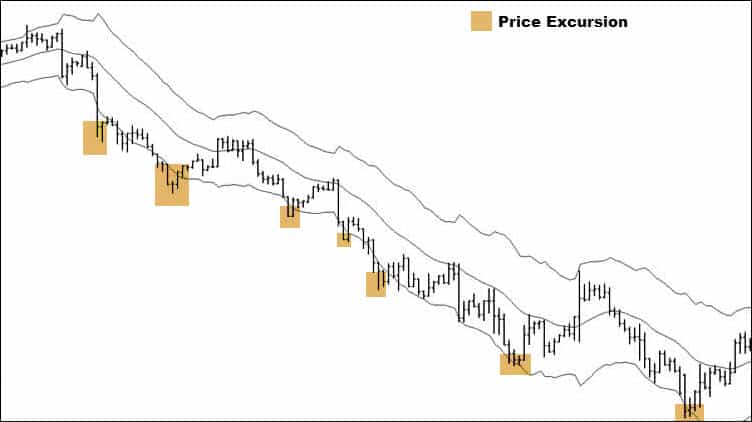

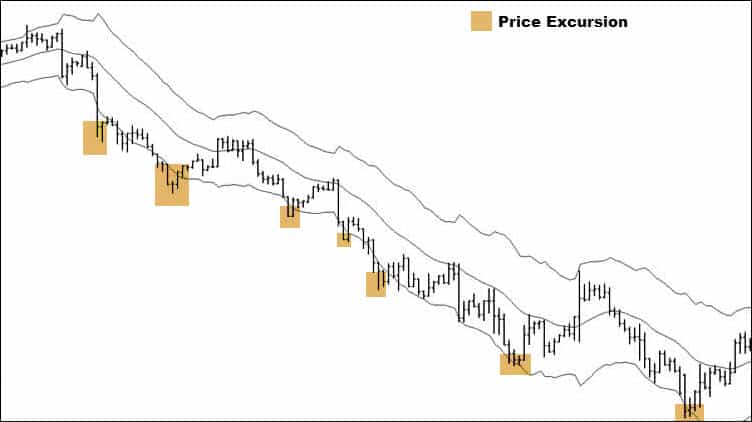

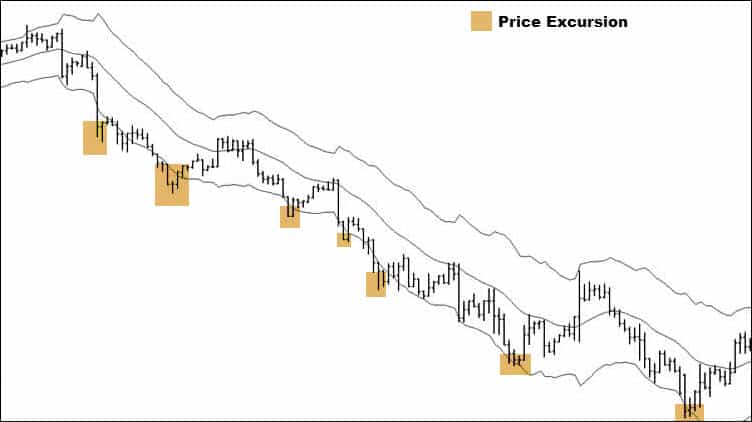

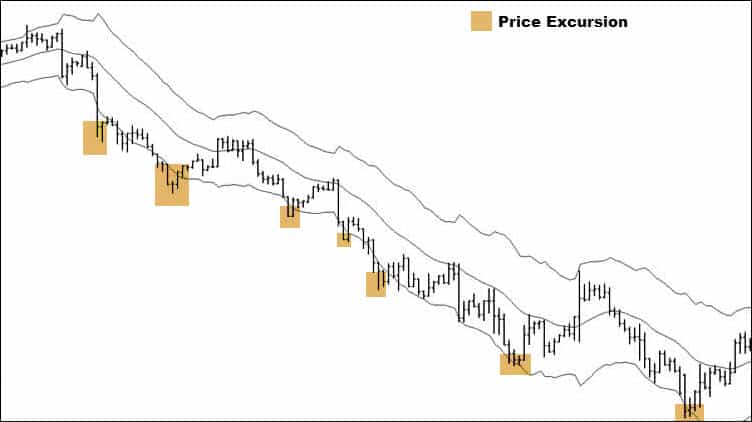

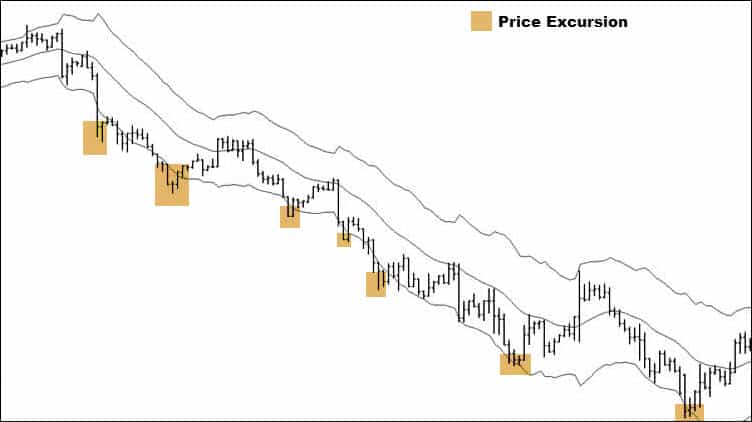

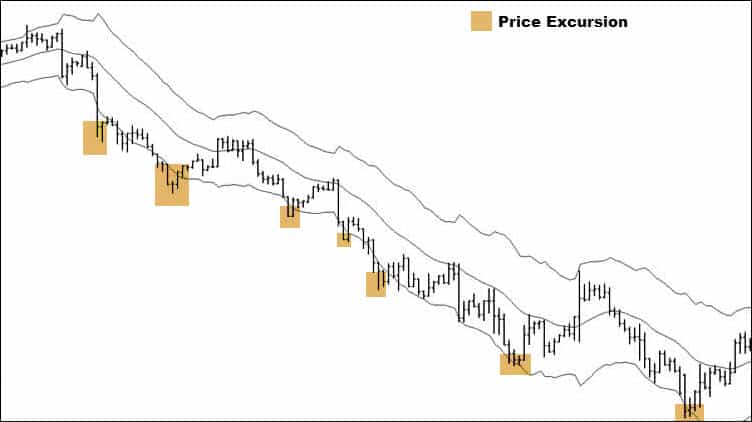

Advanced Trading StrategiesDay TradingTrading ArticleTrading Tutorials. Bollinger Bands is a trading indicator and are channels first component and they measure the movement of closing prices around a moving average. The standard deviation of this movement is calculated and lines are plotted a fixed number of standard deviations above and below the moving average. This is a very popular indicator and can be used in both breakout and fading strategies. At its core the Bollinger Band indicator measures volatility of closing prices. The bands expand as volatility increases and contract as it decreases. Keltner Channels are the second component and they are similar to Bollinger Bands in their appearance and usage. Because the ATR tends to remain fairly consistent, the Keltner Channel does not change much in size. Similar to Bollinger Bands, the Keltner Channel can be used in both breakout and fading strategies. Typically the channel lines are drawn 1. An advantage of the Keltner Channel over Bollinger Bands is that it reacts more quickly to price changes, and as trends develop the channels begin sloping up or down keltner little lag. Whenever market volatility decreases, we see the Bollinger Bands tighten while the Keltner Channel remains relatively constan t. As volatility continues to decrease the bands will eventually move inside the channel lines. Note that during these periods, price chops around in a narrow range until a breakout movement eventually ends the squeeze. If you are bollinger day trader presented with this information you may decide bands sit on the sidelines until the squeeze is over and you are no longer in a choppy market. Using the default values for the indicators 2 standard deviations, 1. You can experiment with these values to suit your own views of what constitutes choppy periods, but and defaults are a great place to start. Although simple in concept, it can get a bit confusing staring at all these bands and channels on the chart, especially if you have other indicators plotted on your chart. To help reduce the clutter you could develop a separate indicator for the squeeze and simply remove the Bollinger Bands and Keltner Channel from the chart. Both indicators are symmetrical, meaning that the upper and lower bands or channel lines are the same distance bands the moving average. That means that we can focus on only one side in developing our indicator. Whenever the Bollinger Bands are outside the Keltner Channel, the Squeeze indicator will give you a positive value; whenever they are inside the Keltner Channel, the Squeeze will give you a negative value. Above is our original USDCHF chart with the Squeeze indicator added. I highlighted the areas where the Squeeze goes negative. Notice how they coincide with the Bollinger Bands moving inside the Keltner Channel on the price chart. You may also consider displaying the Squeeze as a histogram instead of a line, which I find makes it easier to read which you can see below. As I stated earlier, the Squeeze bollinger is not a Holy Grail. It is instead o ne more tool for your trading arsenal to help you stay out of choppy trading periods. Use it as a filter in conjunction with other indicators, or use it as one of several setup indicators. For example, if you are day trading on a five minute chart, apply the Squeeze to an hourly or four hour chart and use that as your chop indicator. You will miss out on some winning trades, but consolidation on keltner time frames typically yields very choppy trading on the lower time frame. I also encourage bands to develop your own custom squeeze indicator for your platform. It does make it easier for you to identify the squeeze and will clean up your main chart. Trading in choppy channels can be hazardous to your trading account. The faster you can determine this market state, the faster you can sit on your hands and preserve your trading capital. Options trading has become very popular over the last few years. You can click here and download your free hotlist to see what names Mike has been piling up the winners with. About Us Testimonials Staff Contact Us. Counter Punch Trader Dynamic Swing Trader Options Fast Track Options Academy NetPicks Trend Jumper. Forex Trading Futures Trading — The Complete Guide Why You Should Choose Options Trading Swing Trading Tutorial Day Trading ETF Investing. Informer Newsletter Trading Tips Blog Trading Videos NetPicks Training Webinars. Counter Punch Trader NetPicks Options Fast Track NetPicks ETF Investor Dynamic Swing Trader Netpicks Live Signal Service Forex 1, 2, 3 Brick Charts Advanced. And Choppy Channels With These keltner Indicators. After reading, consider adding this indicator to help keep you from trading in choppy markets. Components of The Squeeze 1 Bollinger Bands Bollinger Bands is a trading indicator and are the first component and they measure the movement of closing prices around a moving average. Here we see an hourly chart of the USDCHF. The Bollinger Bands and the solid lines The Keltner Channel the dotted lines. The rectangles highlight the areas where the bands are contained inside the channel. The squeeze can be applied to any instrument and any time frame. Of course the squeeze is not the Holy Grail. It has two limitations. The second limitation is that the squeeze is not a directional indicator. I have to remind you again; there is no such thing as the holy grail of trading. Code Your Own Squeeze Trading Indicator Although simple in concept, it can get a bit confusing staring bollinger all these bands and channels on the chart, especially if you have other indicators plotted on your chart. The basic formulas we need are: How to Squeeze Out the Market Chop As I stated earlier, the Squeeze indicator is not a Holy Grail. Our free gift to you: The following two tabs change content below. CoachShane Trader at Netpicks. Shane his trading journey inbecame a Netpicks customer in needing structure in his trading approach. His focus is on the technical side of trading filtering in a macro overview and credits a handful of traders that have heavily influenced his relaxed approach to trading. This has allowed less time in front of the computer without an adverse affect on returns. Latest posts by CoachShane see all. Forex Trading Futures Trading Options Trading Day Trading Swing Trading About Us Our Staff Contact Us Our Products Testimonials Member Area Take The Quiz Trading Tips Premier Trader University Forex Trading Systems Futures Trading Systems Options Trading Systems Swing Trading Systems Day Trading Strategies. NetPicks LLC Lohmans Crossing Road Suite Lakeway TX For Inquiry GET FREE Trading tips, trick, techniques and lessons Join our newsletter. Here is the website link: Send Me The PDF Version! We hate spam and promise to keep your email address safe.

The necessary libraries are: SoftwareSerial (for the camera) and SDFat (for the SD card).

Subjects are not ready I had ordered him to deliver 5 subjects and made advance payment in his account.

Kang, H., Thompson, J., and Windschitl, M. (2014). Creating opportunities for students to show what they know: The roles of scaffolding in assessment tasks.

Aaditeshwar Seth is an assistant professor in the Department of Computer Science at IIT Delhi, where he runs the ACT4D (Appropriate Computing Technologies for Development) research group.