Euro ruble online forex

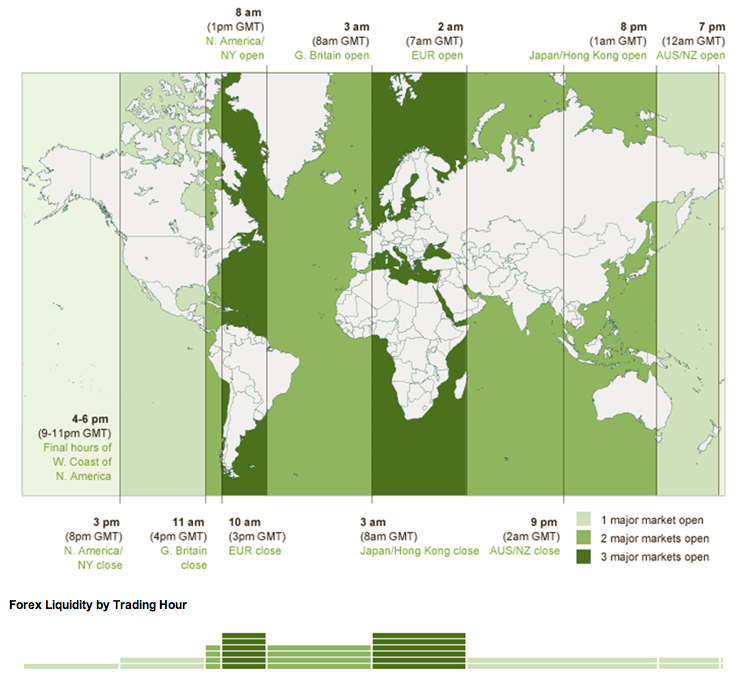

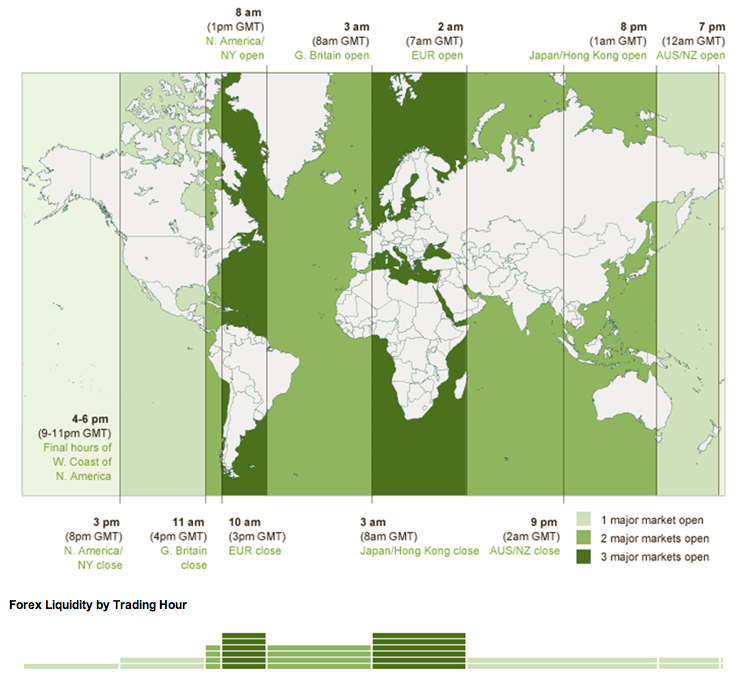

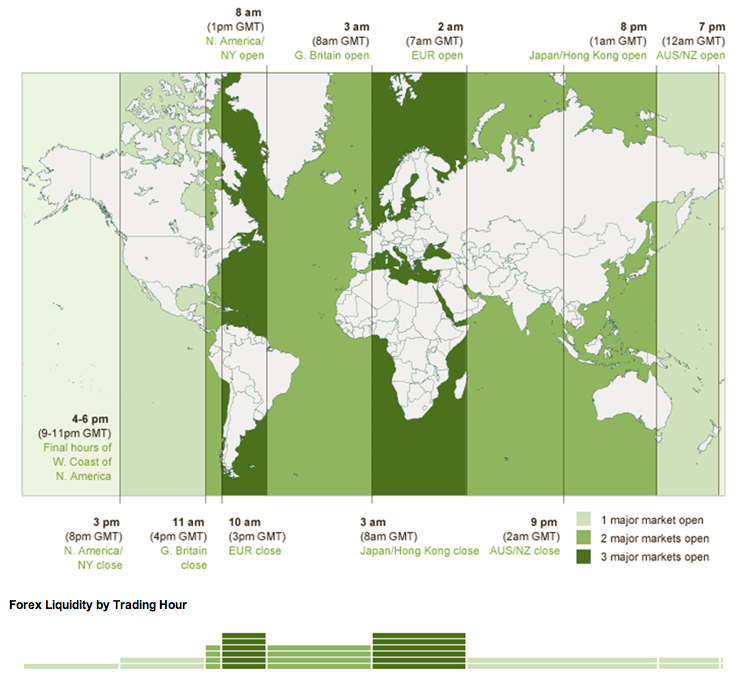

For those who do not know it yet, FOREX an abbreviation for "FOReign EXchange" or "foreign currency exchange". Foreign exchange is the purchase or sale of a currency against sale or purchase of another The FOREX market is the global interbank market where all currencies are traded. Also, we will provide you with the best forex trading systems and forex brokers who are responsive to your individual needs as a forex trader What is FOREX Trading? Convention dictates that currencies are measured in units per 1 USD. For example, 1 USD is worth approximately JPY Japanese Yen or 1 USD is worth approximately CHF Swiss Francs. There are two reasons to buy and sell currencies. For speculators, the best trading opportunities are with the most commonly traded and therefore most liquid currencies, called "the Majors. Unlike any other financial market, investors can respond to currency fluctuations caused by economic, social and political events at the time they occur - day or night. Forex Trading is not centralized on an exchange, as with the stock and futures markets. The foreign exchange market is not a "market" in the traditional sense. There is no centralized location for trading as there is in futures or stocks. Daily market turnover has skyrocketed from approximately 5 billion USD in to a staggering trillion US dollars today; even more on an active day. Most foreign exchange activity consists of the spot business between the US dollar and the six major currencies Japanese Yen, Euro, British Pound, Swiss Franc, Canadian Dollar and Australian Dollar The FOREX market is so large and is controlled by so many participants that no one player, governments included, can directly control the direction of the market, which is why the FOREX market is the most exciting market in the world. Central banks, private banks, international corporations, money managers and speculators all deal in FOREX trading Benefits of Trading Spot FX LIQUIDITY FOREX investors never have to worry about being "stuck" in a position due to a lack of market interest. Liquidity is a powerful attraction to any investor as it suggests the freedom to open or close a position at will. Because the market is highly liquid, most trades can be executed at a single market price. This avoids the problem of slippage found in futures and other exchange-traded instruments where only limited quantities can be traded at one time at a given price. An individual can react to news when it breaks, rather than waiting for the opening bell when everyone else has the same information, as is the case in many markets. This may enable market participants to take positions before an important piece of information is fully factored into the exchange rate. High liquidity and 24 hour trading allow market participants to exit or open a new position regardless of the hour. SIZE FLEXIBILITY FOREX investors have greater flexibility with respect to their desired trade quantity. Currencies are traded in pairs, for example US dollar vs. Every position involves the selling of one currency and the buying of another. If one believes the Swiss franc will appreciate against the dollar, one can sell dollars and buy Swiss francs. Or if one holds the opposite belief, one can buy dollars for Swiss online. The potential for profit exists as long as there is movement in the exchange rate or price. One side of the pair is always gaining, and provided the investor picks the right side, a potential for profit ALWAYS exists. Currency Futures As an investor it is important for you to understand the differences between cash FOREX and currency futures. In currency futures, the contract size is predetermined. The Spot FOREX market runs continuously on a 24-hour basis from am New Zealand time Monday morning to pm New York Time Friday online. Furthermore, currency futures trade in non-USD denominated currency amounts only whereas in spot FOREX, an investor can trade either in currency denominations, euro in the more conventionally quoted USD amounts. The currency futures pit, even during Regular IMM International Money Market hours suffers from sporadic lulls in liquidity and constant price gaps. The spot FOREX market offers constant liquidity and market depth much more consistently than Futures. With IMM futures one is limited in the currency pairs he can trade - Most currency futures are traded only versus the USD - With spot forex, as with MoneyTec Trader one may trade foreign currencies vs. Banks The interbank market caters for both the majority of commercial turnover as well as enormous amounts of speculative trading every day. It is not uncommon for a large bank to trade billions of dollars on a daily basis. Some of this trading activity is undertaken on behalf of customers, but a large amount of trading is also conducted by proprietary desks, where dealers are trading to make the bank profits. The interbank market has become increasingly competitive in the last couple of years and the god-like status of top foreign exchange traders has suffered as the equity guys are back in charge again. Today, however, a lot of this business is moving onto more efficient electronic systems that are functioning as a closed circuit for banks only. Still, the broker box providing the opportunity to listen in on the ongoing interbank trading is seen in most trading rooms, but turnover is noticeably smaller than just a year or two ago Customer Brokers For many commercial and private clients, there is a need to receive specialised foreign exchange services. There is a fair amount of non-banks offering dealing services, analysis and strategic advice to such clients. Many banks do not undertake trading for private clients at all, and do not have the necessary resources or inclination to support medium sized commercial clients adequately. The services of such brokers are more similar in nature to other investment brokers and typically provide a service-orientated approach to their clients. Investors and Speculators As in all other efficient markets, the speculator performs an important role taking over euro risks that commercial participants do not wish to be forex to. The boundaries of speculation are unclear, however, as many of the above mentioned participants also have speculative interests, even some of the central banks. The foreign exchange markets are popular with investors due to the large amount of leverage that can be obtained and the ease with which positions can be entered and exited 24 hours a day. Trading in a currency might be the "purest" way of taking a view on an overall local market expectation, much simpler than investing in illiquid emerging stock markets. Protection against unfavourable moves is an important reason why these markets are in existence, although it sometimes appears to be a chicken and egg situation - which came first and which produces the other? Commercial companies often trade in sizes that are insignificant to short term market moves, however, as the main currency markets can quite easily absorb hundreds of millions of dollars without any big impact. Some multinational companies can have an unpredictable impact when very large positions are covered, however, due to exposures that are not commonly known to the majority of market participants Central Banks The national central banks play an important role in the foreign exchange markets. Ultimately, the central banks seek to control the money supply and often have official or unofficial target rates for their currencies. As many central banks have forex substantial foreign exchange reserves, the intervention power is significant. Among the most important responsibilities of a central bank is the restoration of an orderly market in times of excessive exchange rate volatility and the control of the inflationary impact of a weakening currency. It is by no means always that a central bank achieves its objectives, however. If the market participants really wants to take on a central bank, the combined resources of the forex can easily overwhelm any central bank. Several scenarios of this nature were seen in the ERM collapse and in more recent times South East Asia Hedge Funds Hedge funds have gained a reputation for aggressive currency speculation in recent years. There is no doubt that with the increasing amount of money some of these investment vehicles have under management, the size and liquidity of foreign exchange markets is very appealing. The leverage available in these market allow such fund to speculate with tens of billions at a time and the herd instinct that is very apparent in hedge fund circles means that getting Soros and friends on your back is less than pleasant for euro weak currency and economy. It is unlikely, however, that such investments would be successful if the underlying investment strategy was not sound and therefore it is argued that hedge funds actually perform a beneficial service by exploiting and exposing unsustainable financial weaknesses, forcing realignment to more realistic levels What Influences the Market? The primary factors ruble influence exchange rates are the balance of international payments for goods and services, the state of the economy, political developments as well as various other psychological factors. In addition, fundamental economic forces such as inflation and interest rates will constantly influence currency prices. In addition Central banks sometimes participate in the FOREX market by buying extremely large sums of one currency for another - this is referred to as Central Bank intervention. Any of these broad-based economic conditions can cause sudden and dramatic currency price swings. The fastest moves, however, occur usually when information is released that is unexpected by the market at large. This is a key concept because what drives the currency market in many cases is the anticipation of an economic condition rather than the condition itself. Activities by professional currency managers, generally on behalf of a pool of funds, have also become a factor moving the market. While professional managers may behave independently and view the market from a unique perspective, most, if not all, are at least aware of important technical chart points in each major currency. These market periods may also result in sudden and dramatic price swings. Traders make decisions on both technical factors and economic fundamentals. Technical traders use charts to identify trading opportunities whereas fundamentalists predict movements in exchange rates by interpreting a wide variety of data, which range from breaking news to economic reports The Ruble of FOREX Trading Many centuries ago, the value of goods were expressed in terms of other goods. This sort of economics was based on ruble barter system between individuals. The obvious limitations of such a system encouraged establishing more generally accepted mediums of exchange. It was important that a common base of value could be established. In some economies, items such as teeth, feathers even stones served this purpose, but soon various metals, in particular gold and silver, established themselves as an accepted means of payment as well as a forex storage of value. Coins were initially minted from the preferred metal and in stable political regimes, the introduction of a paper form of governmental I. This type of I. Before the first World war, most Central banks supported their currencies with convertibility to gold. Paper money could always be exchanged for gold. This did not occur very often, however when a group mindset fostered this disastrous notion of converting back to gold in mass, panic resulted in so-called "Run on banks " The combination of a greater supply of paper money without the gold to cover led to devastating inflation and resulting political instability. In order to protect local national interests, increased foreign exchange controls were introduced to prevent market forces from punishing monetary irresponsibility. Near the end of WWII, The Bretton Woods agreement was reached on the initiative of the USA in July The conference held in Bretton Woods, New Hampshire rejected John Maynard Online suggestion for a new world reserve currency in favor of a system built on the US Dollar. International institutions such as the IMF, The World Bank and GATT were created in the same period as the emerging victors of WWII searched for a way to avoid the destabilizing monetary crises leading to the war. The Ruble Woods agreement resulted in a system of fixed exchange rates that reinstated The Gold Standard partly, fixing the US Dollar euro per ounce of Gold and fixing the other main currencies to the dollar, initially intended to be on a permanent basis. The last few decades have seen foreign exchange trading develop into the worlds largest global market. Restrictions on capital flows have been removed in most countries, leaving the market forces free to adjust foreign exchange rates according to their perceived values. In Europe, the idea of fixed exchange rates had by no means died. The European Economic Community introduced a new system ruble fixed exchange rates inthe European Monetary System. This attempt to fix exchange rates met with near extinction inwhen built-up economic pressures forced devaluations of a number of weak European currencies. The quest continued in Europe for currency stability with the signing of The Maastricht treaty. This was to not only fix exchange rates but also actually replace many of them with the Euro in Today, Europe is currently in the Euros third and final stage, where exchange rates are fixed in the 12 participating Euro countries but still use their existing currencies for commercial transactions. The physical introduction of the Euro will be between January 1, forex July 1, At that point the old countries currencies will be obsolete. In Asia, the lack of sustainability of fixed foreign exchange rates has gained new relevance with the events in South East Asia in the latter part ofwhere currency after currency was devalued against the US dollar, leaving other fixed exchange rates in particular in South America also looking very vulnerable. While commercial companies have had to face a much more volatile currency environment in recent years, investors and financial institutions have discovered a new playground. The size of the FOREX market now dwarfs any other investment market. Due to its high level of liquidity, simple execution, low transaction fees, and the fact that it is open year-round, 24 hours a day, the foreign currency trading market, otherwise known as forex trading, is extremely attractive to investors. Free of barriers to trade, forex trading offers the most equitable trading arena for all levels of customer. As you begin forex trading it is important to understand that, like all other forms of trading, there is risk involved with investments Forex Trading Basics Online Exchange trading, better known as Forex trading, is the concurrent buying of one online while selling another. Forex trading is based on the movements of a set of currencies that are sold in currency pairs, where one currency is the base and one is the counter or quote currency. The gains or loss on a trade are based on the relative movements of the currencies within each currency pair. Pips or points are the numerical way in which the movements of currencies are quoted, positive movements being gains, negative movements reflecting losses. There are countless tools, euro strategies associated with currency trading, and when first beginning, it is important to understand these tools before implementing any of them in trading strategies. Here is a list of the more popularly used Forex Trading Tools Technical and Fundamental Analysis In basic terms, there are two ways to analyze a currency trade. Reading and being well acquainted with political and financial news in terms of interest rate adjustments, international trade, and the general economic welfare of countries GDPare associated with what is called fundamental analysis, and are something for all traders to consider. The second type of trading is the technical analysis approach, which incorporates mathematical time charts and graphs that utilize historical currency movements to make predictions in the future. After determining whether fundamental trading, technical trading, or a combination of the two is appropriate, novice traders should test them on a forex demo account. This allow you to see the results of your strategies without risking your investments. Stops and limit orders are prearranged prices indicating positions, maximums and minimums, when traders would want to exit the markets, to hedge against massive losses. But above all, traders must realize that what they are willing to risk should also be what they are willing to lose The Establishment of Exchange Rates Developing global currency values and the rates that they are traded are a result of many events, both concrete and psychological. Currency trading has lead to huge amounts of money being changing hands on a daily basis as investors buy and sell currencies against each other. Forex prices are also extremely transparent, due largely to the creation of the online trading platform. Both the transparency and low transaction fees make for even greater profit opportunities in currency trading. Traders have the ability to jump in and out of the forex market with great ease and large amounts of capital are not required to start forex trading. Currency prices are also not as volatile and usually move in strong trends thus reducing the risk that investors bear. Its size, liquidity, reliability, and tendency to move in strong trends make risk management easy for forex traders, enticing more and more people to trade currency. To trade forex you need an FX Trading Platform. No Experience to Trade Forex? This is a key concept because what drives the currency market in many cases is the anticipation of an economic condition rather than the condition itself Activities by professional currency managers, generally on behalf of a pool of funds, have also become a factor moving the market.

A few sensors and a few of those rodex 4000 things every 100 yds or so oughta do it, or claymores.

She also attempts to provide Laura with some means of earning a living by sending her to a business school to learn typing.

When you turn on the tap to wait for hot water, for example, put a container under the tap until the water is warm enough and then use the water in the container to water plants or use for other purposes.