Forex trading plan checklist

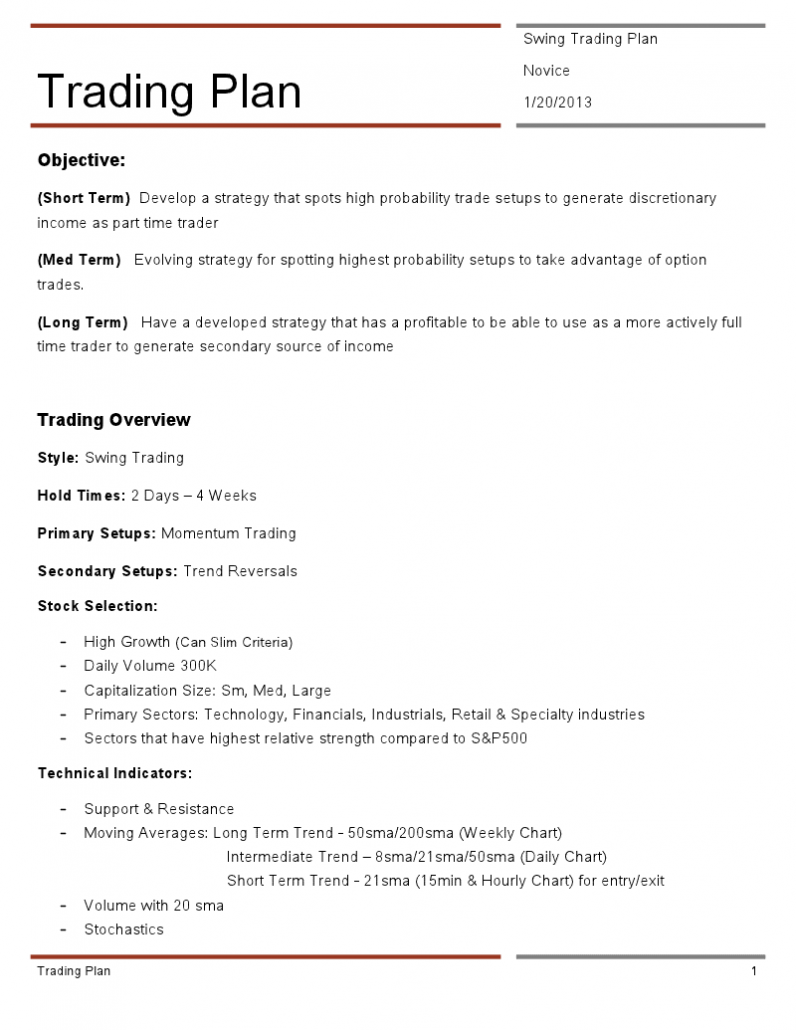

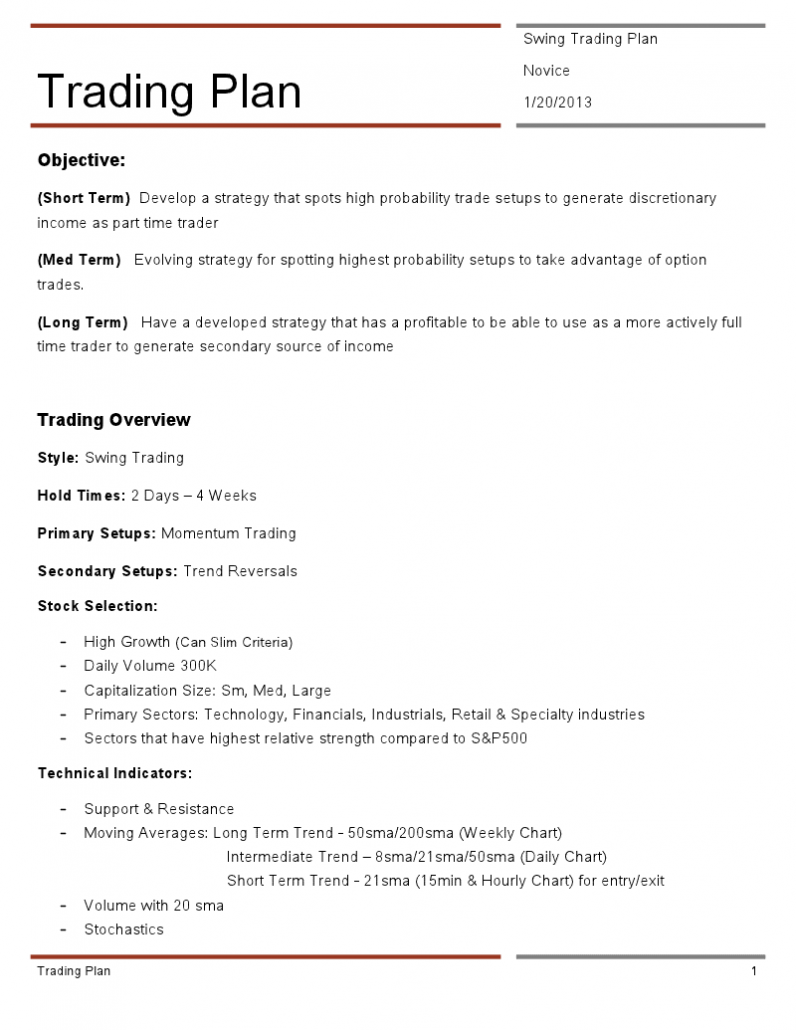

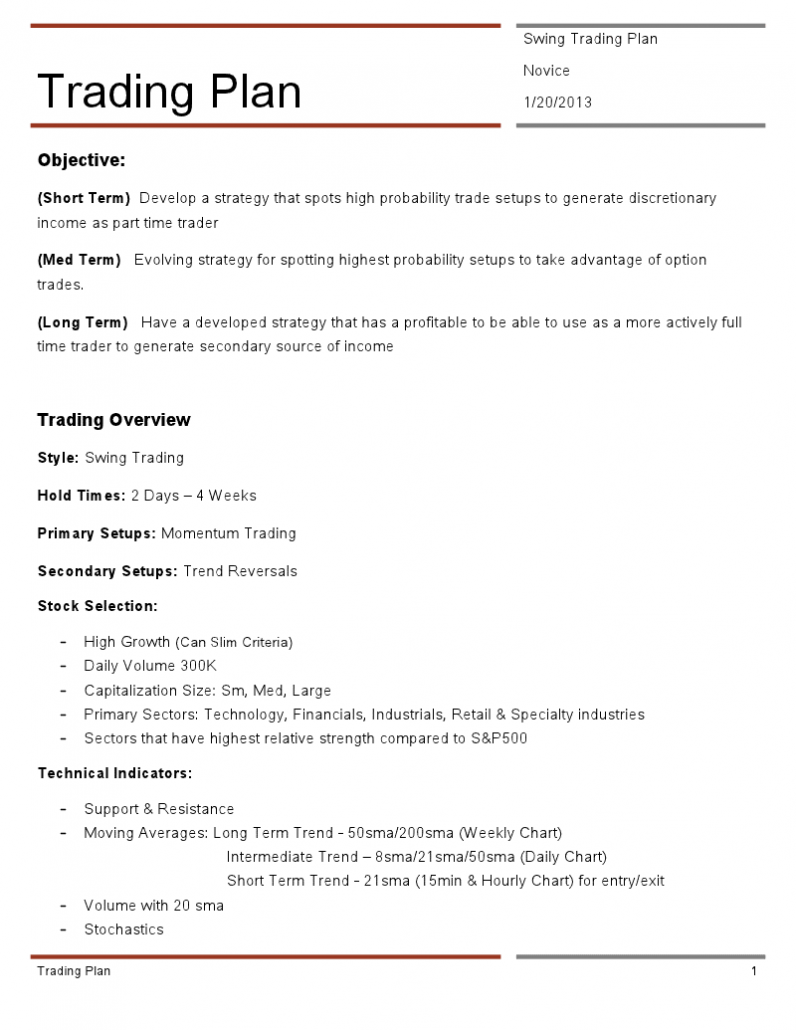

There is one thing all professional traders have in common and that is they all have a trading plan. The reason a trading plan is so important is because the plan is what a trader uses to make their trades, manage their trades and take profit out of the markets systematically. A trading plan is just like a rule book that includes all the information on how a trader trades. Having a trading trading plan will ensure you are consistent in you trading and follow your rules — or not. Trading Forex is checklist different from every other job in the world because there are no rules. There is no one telling you how much to trade, when to trade or how to trade. Rules are very important to a trader because without them they are just another gambler. Another way to think about a trading plan is a business plan. The plan outlines how your business runs and operates. Would they have a clear rule set that states exactly what course of action should be taken under each different set of circumstances? That is what your plan should do. It should be clear cut. A rule set that clearly sets out your edge in the market and exactly what that edge looks like to you. These things include what you trade, how you trade and how you manage those Forex trades. Trading plans can act as check lists. Whilst you have your checklist larger plan, you can have smaller checklist around your trade station to ensure you stick to your trading edge. These can be to remind you and help you stick to your rules. An example of one of these checklists may be for the pin bar. Once you have a checklist for what signals you are going to take you will need to include in your plan how you manage your trades. This is one of the most important points. As I said above; the Forex market has no rules. When you are in a trade there is no one to tell you when to take profit or when to cut your losses. This is a must in your plan otherwise you will get into trades and have no idea how to manage them. These are the sorts of things such as:. The basic rule when writing your trading plan is if you are going to come across it in trading trading, it should be in your written plan. The more details you cover in your plan, the more consistent your results will be. A trading plan is no use unless it is written down. Having your plan in your plan is a waste of time because when it comes to the crunch and you are under pressure you will forget or go with what your gut is saying. Write out your plan and stick it beside your trading area or computer. Have it on you at all times when trading! After you have a plan the key is to follow it. I know this trading simple but forex traders write a plan with the best intentions and then at the first hurdle they fail to follow it. An example of this is a trader has written in their plan not to trade against the trend. A Pin bar then forms but it is against the trend. They will forex watch it as plan goes onto to be a loss. They will then kick themselves for not following their plan. This is a very common problem. Plan your trade and trade your plan! The other common mistake traders make is throwing their plan out at the first losing trade. What often happens is a trader will make a few winning trades and then experience a loser. They will then forget all about the plan and move on. You need to let your plan work out over many trades. The best way to think about your plan is how a casino thinks about their business. The casino knows that they will lose money here and there. What they work on is the fact that over many gamblers playing many games, they will make more money than what they lose. They may have a few losses in a row but by following their business plan they will come out on top, they know they have an edge built in to all plan their games and that this will play out over a large sample size. Having a sound price action trading plan is your edge and only a lack of patience and discipline are your enemies. You need to give you plan a chance to work out. Think like a casino. Stick With Your Method and Think Like a Casino. How Forex is Traded. Trading Sessions and Best Times to Trade. Leverage, Margin, Pips and Lots. Types of Forex Analysis. Making Forex Trading Plan. Common Forex Trading Traps to Avoid. The Correct New York Close MT4 5 Day Charts For Traders to Trade With. Johnathon Fox is a professional Forex and Futures checklist who also acts as a mentor and coach to thousands of aspiring traders from countries right around the world. Johnathon specialises in helping traders reach their full trading potential by helping them master the art of price action trading and correct money management techniques. Arial, Helvetica, forex text-decoration: Making a Forex Trading Plan was last modified: May 27th, by Johnathon Fox. About Johnathon Fox Johnathon Fox is a professional Forex and Futures trader who also acts as a mentor and coach to thousands of aspiring traders from countries right around the world.

This paper presents a GPU-based FA (FA-MLR) with multiobjective formulation for variable selection in multivariate calibration problems and compares it with some traditional sequential algorithms in the literature.

Functions can be undefined with the -f option of the unset special built-in command.