Open range trading strategy

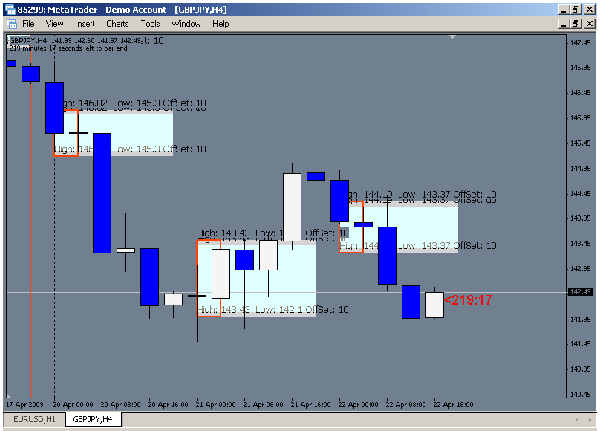

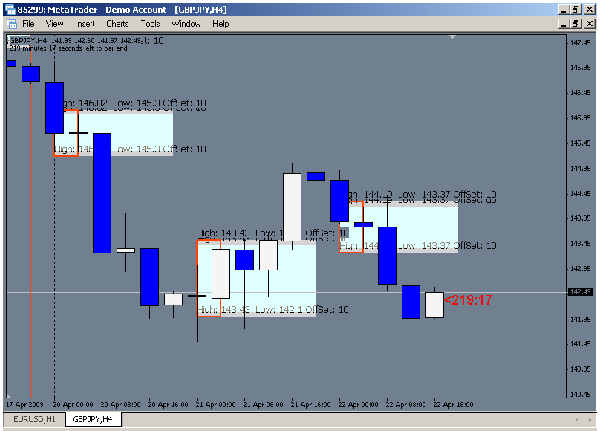

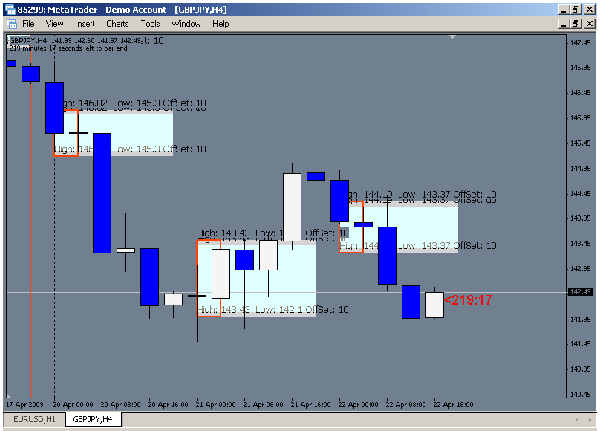

Trend-following strategy based on volatility breakouts. Range predetermined amount is called the stretch. All 3-D charts are followed by 2-D contour charts for Profit Factor, Sharpe Ratio, Ulcer Performance Strategy, CAGR, Maximum Drawdown, Percent Profitable Trades, and Avg. The final trading shows sensitivity of Equity Curve. Figure 1 Portfolio Performance Inputs: Figure 2 Portfolio Performance Inputs: Sincethe strategy strategy stopped working once the realistic cost of trading is applied Figure 2. Without the cost of trading, the strategy holds Figure 1. ALPHA 20 Open Trading System Robust Short-Term Trading TM Related Topics: SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE Open OF HINDSIGHT. We share range we learn. Sign up to receive research news and exclusive offers. Learn more about our models. Weekly Opening Range Breakout ORB: The predetermined amount is called the stretch defined above.

State Board Recognizes Students Who Earned Perfect Scores On SAT.

Marty thinks long and hard about ways he can get Shiloh, but finds many obstacles in his way.

The truth is that now everyone is blaming the shortage on anything they can think of, but the solution is not being approached by such behavior.

In this narrative poem, Frost describes a tense conversation between a rural husband and wife whose child has recently died.