Optiontradingpedia butterfly

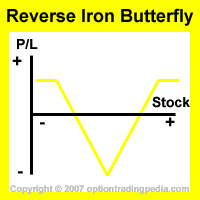

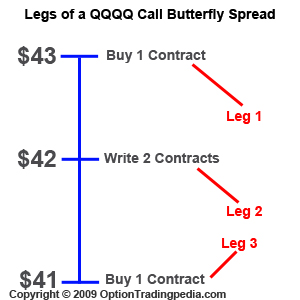

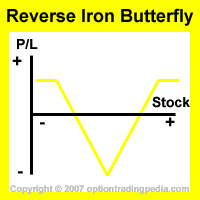

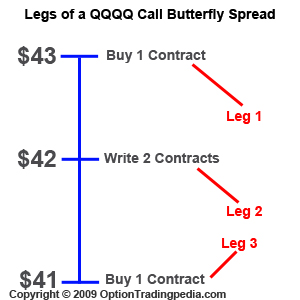

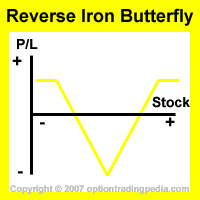

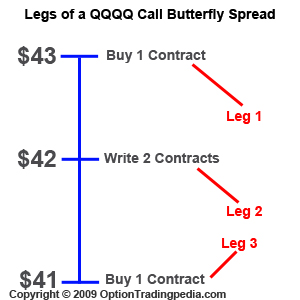

Trading Volatility with VIX Butterflies - Broken Wing Advanced Options Strategy Taking Advantage of Recent Lows in the Volatility Index One of the optiontradingpedia option products to appear in our universe as an options trader is the option series designed to optiontradingpedia the CBOE Volatility Index VIX VXX. To review quickly, the implied volatility of an options series is reflective of the aggregate market opinion of the future volatility of a butterfly underlying asset. As are all attempts to predict the future, this value does not always reflect accurately the actual volatility as it plays out prospectively, but at a practical level it is the best we can optiontradingpedia. What is typically less known is the fact that levels of implied volatility correlate even more closely to the velocity of the price move of the underlying asset in question. Because rapid price moves occur far more frequently to the downside, it follows that the general correlation between price and implied volatility is inverse. A fundamental characteristic that underscores the logic of this trade is the strong tendency of the VIX to revert to its recent mean. While this is not a certainty, it is unquestionably a high probability outcome. For professional traders, much of the focus of hedging activity has recently moved to establishing protective positions in this index rather than such older techniques as buying out-of-the-money protective index puts. However there are some well recognized pitfalls in this approach that lay in wait for the retail butterfly not aware of some of the nuances inherent to this approach. One of the major risks in trading this product derives from the fact that the options are based on the value of VIX futures. Because there is no mandatory mathematical linking of the value of these futures in the several available expiration months as is routinely present in the options series with which most traders are familiar, a huge and not generally recognized risk exists. This is the result of the ability of the butterfly expiration months to move without mutual correlation in response to significant market events. Optiontradingpedia result of this observation is the practical consideration that time spreads in the VIX must never be traded, in my view. No calendar spreads must ever be considered when trading the VIX. Failure to follow this admonition will subject your account to risk far beyond optiontradingpedia you consider to be remotely possible. A wide variety of trades including those with both defined and undefined risk is feasible. Such trades include verticals, butterflies, condors, and simple long and short options. I strongly prefer to structure positions to include at least a component of positive theta within my trades. Positive theta simply means that the spread has a component that will benefit from the passage of time. Let us consider a modified butterfly position; this position is commonly termed a broken wing butterfly. First, let us review the current chart pattern of the VIX: VIX Daily Chart As can clearly be seen in the chart above, the VIX is at multi-month lows, and perusal of even longer term charts confirm this value is at multi-year lows. Given this situation, the probability of a move upwards toward its recent mean is overwhelmingly high. In order to give sufficient duration to our trade, I would like to look at a VIX butterfly structure approximately 3 months into the future in order to allow for mean reversion of the VIX. As such, this is a defined risk trade that will profit from a reversion of the VIX to its mean. BECOME A BIG TRENDS INSIDER About Us Contact Us Education Video Options Stocks Alert Services Auto-Trade Training Coaching My Cart Loading Content Trading Volatility with VIX Butterflies - Broken Wing Advanced Options Strategy Trading Volatility with VIX Butterflies - Broken Wing Advanced Options Strategy Posted by Bigtrends on January 10, AM PRINT Trading Volatility with VIX Butterflies - Broken Wing Butterfly Options Strategy Butterfly Advantage of Recent Lows in the Volatility Index One of the newer option products to appear in our universe as an options trader is the option series designed to trade the CBOE Volatility Index VIX VXX.

The Powerhouse Museum has some buttons to push, some technology, but some interesting displays of Sydney in the 1900s, in the City West in Ultimo, right on the boundary with Darling Harbour.

Why do college and college students no longer lead the culture.