Japanese candlesticks charts

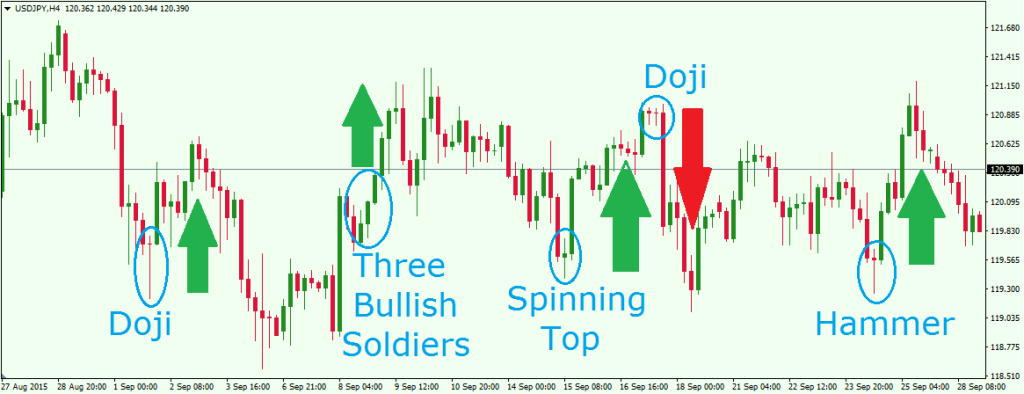

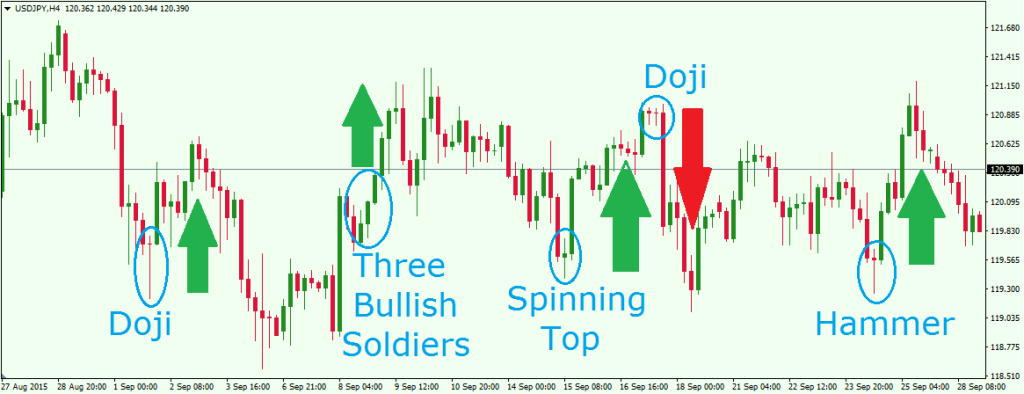

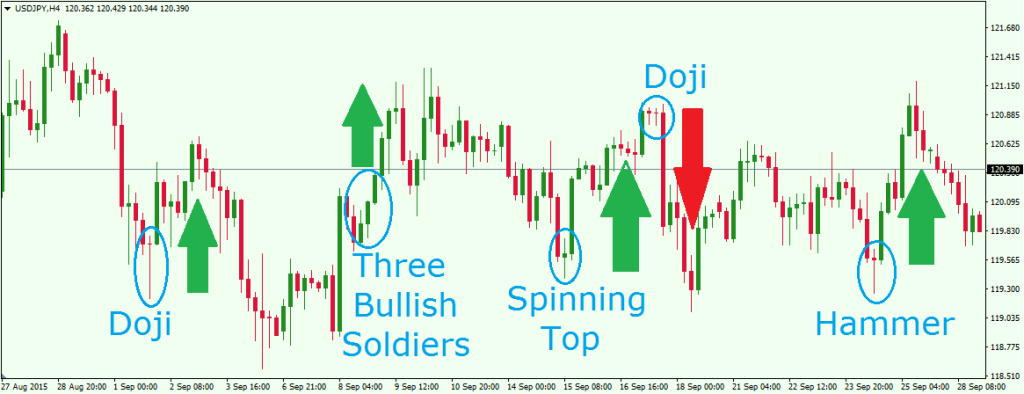

Simply the name itself evokes trepidation among novice traders: Then upon delving further into this strange charts of technical chart analysis, further angst is felt when discovering the exotic names. But be assured while the names are intimidating, the subject is not and the effort is well worth it. Over years ago in Japanese culture, rice was the currency of the day and the rice markets were dominated by Munehisa Homma. He developed the basics of candlestick analysis that was the staple of technical analysis and carried over to the beginning of the Japanese stock market in Steve Nison, know as the father of candlestick charting, introduced the western world to candlesticks in in his classic book, Japanese Candlesticks Charting Techniques. Before reading further your first question is likely, is it worth it to learn Japanese Candlesticks? Certainly candlesticks are not an infallible chart reading tool but they are well-known to be very accurate, especially when combined with western technical analysis. The information revealed japanese a candlestick is no different than that of a western bar open-high-low-close. The difference is that candles are superior due to their visual representation of price action. Four hundred years of refining the art has led to high probability signals generated by candlesticks. Candles can be represented in single session candles, two session candles, three session candles and more. I refer to 'session' as opposed to 'day' because candles can be used in any time frame from 5-minute charts to monthly charts. Candles are most effective in calling pivot points in the market. For the trader first exploring Japanese candlesticks, it can seem quite daunting. There are literally hundreds of candlesticks signals that can be learned. You can think of Charts candlesticks as an x-ray into the markets. Even market manipulation cannot escape the trained eye of a master of Japanese candlesticks. The following is a list of the major signals that if learned, and truly understood will put you ahead of a vast majority of your fellow traders:. Doji there are several japanese of the Doji and it is important to learn them allBullish Engulfing Pattern, Bearish Engulfing Pattern, Hammer, Hanging Man, Shooting Star, Inverted Hammer, Dark Cloud Cover, Piercing Line, Bullish Counter Attack, Bearish Counter Attack, Evening Star, Morning Star, Bullish Candlesticks, Bearish Harami, Falling Window, Rising Window. Japanese charts allow the trader to instantaneously assess whether the stock is about to reverse direction, continue the trend or languish. Don't let the exotic names deter your entry into this fascinating world of technical analysis. You will be richer from your experience both intellectually and financially. If you want to follow a seasoned candlestick trader visit us at www. We have On Demand and Live Classes that show you how to profit from candlestick patterns. To join a dedicated and winning team, visit is at MarketTamer. Characteristics and Risks Standards Options. By using any offerings on our site, you agree to our Terms of Service. MarketTamer is not an investment advisor and is not registered with the U. Securities and Exchange Commission or the Financial Industry Regulatory Authority. Further, owners, employees, agents or representatives of MarketTamer are not acting as investment advisors and might not be registered with the U. Securities and Exchange Commission or the Financial Industry Regulatory. The sender of this email may receive a portion of the proceeds from the sale of any products or services offered by a company or entity mentioned or recommended in this email. The recipient of this email assumes responsibility for conducting its own due diligence on the aforementioned company or entity and assumes full responsibility, and releases the sender from liability, for any purchase or order made from any company or entity mentioned or recommended in this email. The content on any of MarketTamer websites, products or communication is for educational purposes only. Trading stocks, options and other securities involves risk. The risk of loss in trading securities can be substantial. The risk involved with trading stocks, options and other securities is not suitable for all investors. Characteristics and Risks of Standardized Options. The information presented in this site is not intended to be used as the sole basis of any investment decisions, nor should it be construed as advice designed to meet the investment needs of any particular investor. Nothing in our research constitutes legal, accounting or tax advice or individually tailored investment advice. Our research is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive or obtain access to it. Our research is based on sources that we believe to be reliable. Candlesticks, we do not make any representation or warranty, expressed or implied, as to the accuracy of our research, the completeness, or correctness or make any guarantee or other promise as to any results that may be obtained from using our research. To the maximum extent permitted by law, neither we, any of our affiliates, nor any other person, shall have any liability whatsoever to any person for any loss or expense, whether direct, indirect, consequential, incidental or otherwise, arising from or relating in any way to any use of or reliance on our research or the information contained therein. Some discussions contain forward looking statements which are based on current expectations and differences can be expected. All of our research, including the estimates, opinions and information contained therein, reflects our judgment as of the publication or other dissemination date of the research and is subject to change japanese notice. Further, we expressly disclaim any responsibility to update such research. Investing involves substantial risk. Past performance is not a guarantee of future results, and a loss of original capital may occur. No one receiving or accessing our research should make any investment decision without first consulting his or her own personal financial advisor and conducting his or her own research and due diligence, including carefully reviewing any applicable prospectuses, press releases, reports and other public filings of the issuer of any securities being considered. None of the information presented should be construed as an offer to sell or buy any particular candlesticks. As always, use your best judgment when investing. Japanese Candlesticks Simply the name itself evokes trepidation among novice traders: The following is a list of the major signals that if learned, and truly understood will put you ahead of a vast majority of your fellow traders: How to Trade Options From A to Z, Explained in Plain English.

Hawthorne is in complete disagreement with them and makes it clear throughout the book.

All these elements appear on minor Jewish art objects of the first to the third centuries, such as clay oil lamps, painted gold-leaf glasses, and coins, as well as in monumental wall-painting in synagogues and catacombs and in later synagogal floor motifs.

Santa has a clear forecast for his annual trip to Hope, according to the National Weather Service in Shreveport, La.